Daft.ie Report Details Impact of Pandemic on Ireland’s Rental Market

Property portal Daft.ie released its latest rental report today, authored by Professor Ronan Lyons, which reflected the key data for the market in Q4 2020.

The average monthly rent across Ireland has increased year-on-year by 0.9 percent and currently stands at €1,414 per month. The main headline around the release tells an interesting story, that is, the pandemic has had contrasting impacts in Dublin and the rest of the country, according to the report author:

“Outside Dublin, Covid-19 has led to a further worsening of supply conditions in the rental market, with the number of homes coming on each month down 17% on already low levels. While demand for rental homes outside the capital has fallen – with the rise in unemployment – it has not fallen as much as supply, pushing rents further upwards. In Dublin, Covid-19 has had the opposite effect, with the number of homes being advertised to rent up 64% on February 1st, compared to a year previously. With the increase in homes being advertised, active demand for homes to rent has also soared, up 40% compared to pre-pandemic.”

Significantly, stock levels across Dublin are up 64 percent since this time last year. There are 2,600 homes available to rent in Dublin this month, compared to fewer than 1,600 homes available in February 2020.

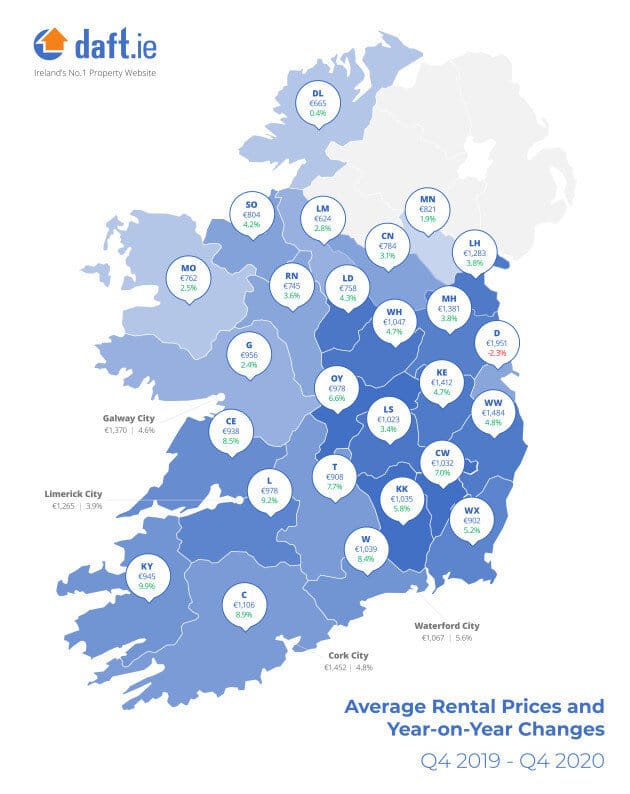

Breaking down the above national average figure, rents outside of Dublin rose by 5.4 percent whereas monthly rent in the capital fell by 3.3 percent during this period. Average Dublin rents currently stand at €1,984, while all other urban centres experienced rental increases over the past 12-months. Breaking down the Dublin marketplace, city centre rents fell 5.6 percent to an average of €1,972. North county Dublin fared better with rental dropping only 0.1 percent, to an average of €1,732 per month. West county Dublin fared similarly well with a drop of 0.7 percent to €1,814. Average monthly rent in South county Dublin currently stands at €2,189.

Outside of the capital, there are just 1,139 homes available this month, whereas this time last year, stock levels were at about 2,000.

Waterford city saw the largest month price increases, with average rents now standing at €1,067, which is up 5.6 percent. In Cork city, monthly rent levels have increased 4.8 percent and currently average €1,452, depending upon the type, location and quality of the accommodation. Similarly, Galway city saw monthly rents increase by 4.6 percent to €1,379. Limerick was the city that experienced the lowest year-on-year increases, with average rents there rising 3.9 percent to €1,265.

Outside of the urban centres, regional rents increased an average of 5.6 percent to an average of €1,048 per month.

Whilst Dublin city and county remains the most expensive place to rent, Ireland’s most affordable countries for rental homes are Longford, Mayo, Roscommon, Leitrim, Donegal and Cavan.

About Castlehaven Finance:

Established in 2014, Castlehaven Finance has provided development finance for both private and social housing to developers, builders and project owners across Ireland in excess of €1.1 billion (151 loans). With offices in Dublin and Cork, the company currently employs close to 20 people. The team at Castlehaven Finance have been involved in the delivery of more than 3,500 new homes, both private and social, across the State.

With offices in Dublin and Cork, Castlehaven Finance has provided development finance for both private and social housing to developers, builders and project owners across Ireland in excess of €1.7 billion (200+ loans) since 2014. Speak to the Castlehaven Finance team about your next commercial or residential development project https://www.castlehavenfinance.com/contact